Who we are at Club Del Internet Network!

Club del internet offers products and services to discount price to the Club Members. We offer 100's of products that are essentials to the day to day needs, and operations, in their lives.

Bike RD Featured collection

-

Motorized Bike Friction Power Generator Generation Dynamo Rear Tail Light Kit

Regular price $18.69 USDRegular priceUnit price per$20.99 USDSale price $18.69 USDSale -

Oxford Cloth 12 Inch Scooter Carrying Bag Wear Resistant Children Bike Storage Bag Kids Balance Bicycle Scooter Cover

Regular price $33.48 USDRegular priceUnit price per -

New Original Bicycle 29 Mountain Black Mountain Bike Bikes for Men 27.5

Regular price $269.75 USDRegular priceUnit price per -

Bike Biycle Durable Aluminum Alloy Rocket Shaped Valve Stem Caps

Regular price $3.78 USDRegular priceUnit price per$4.13 USDSale price $3.78 USDSale -

Mountain Bike

Regular price $269.75 USDRegular priceUnit price per -

Bike Wholesale,

Regular price $1,530.00 USDRegular priceUnit price per -

Bike Bicycle Aluminum Alloy Adjustable Water Bottle Cage Holder

Regular price $5.61 USDRegular priceUnit price per$15.99 USDSale price $5.61 USDSale -

Bicycle Coated Steel Display Floor Rack Bike Repair Stand Used

Regular price $40.50 USDRegular priceUnit price per$76.71 USDSale price $40.50 USDSale

Fall Collections

-

Sleeves Top

Regular price $67.75 USDRegular priceUnit price per

Spring Collections

Summer Collections

Find your products Members Specials!

Beauty and Parfums

Beauty and Parfume. AMOUAGE - Library Opus I Eau De Parfum Spray...

2023 New Anime Marvel Men Socks Long Sock Men‘s Knee-High Couples cosplay Sock Personality Hip Hop Harajuku Funny Sock for Women

Fitness and Sport

Fitness and Sport

Beauty & Fragrance Collection

-

Garlic masher Cutting, pressing and pulling garlic masher

Regular price $3.28 USDRegular priceUnit price per -

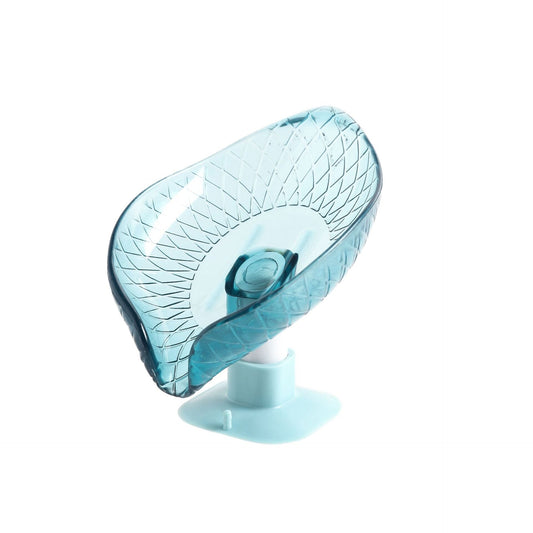

Soap Holder

Regular price From $7.08 USDRegular priceUnit price per$7.08 USDSale price From $7.08 USD -

Cup Soap dish For bathroom

Regular price $8.84 USDRegular priceUnit price per$8.84 USDSale price $8.84 USD -

Electric Spin Power Scrubber Cordless Power Cleaning Brush

Regular price $9.00 USDRegular priceUnit price per -

4 In 1 Handheld Electric Vegetable Cutter Set Slicer Vegetable Spiral Slicer Cutter Masher Machine Kitchen Tool Multifunctional

Regular price $6.24 USDRegular priceUnit price per$6.24 USDSale price $6.24 USD -

Portable Power Station

Regular price $304.64 USDRegular priceUnit price per$0.00 USDSale price $304.64 USD -

Manual potato mud press baby complementary food masher wavy potato press kitchen gadget press potato artifact

Regular price $2.15 USDRegular priceUnit price per -

Intelligent fruit and vegetable Facial Mask Machine DRY Fruit Facial Mask machine

Regular price $31.85 USDRegular priceUnit price per -

Swan drain basket same model kitchen sink sink leftovers soup filter rack hanging cross-border wholesale manufacturers wholesale

Regular price $2.41 USDRegular priceUnit price per -

Portable Household Juice Machine

Regular price $28.73 USDRegular priceUnit price per -

Height detector for home

Regular price $10.51 USDRegular priceUnit price per -

Hang according to the fan neck fast cooling air conditioning hanging ear neck Xiaofeng fan U belt on the neck of the body

Regular price From $5.25 USDRegular priceUnit price per

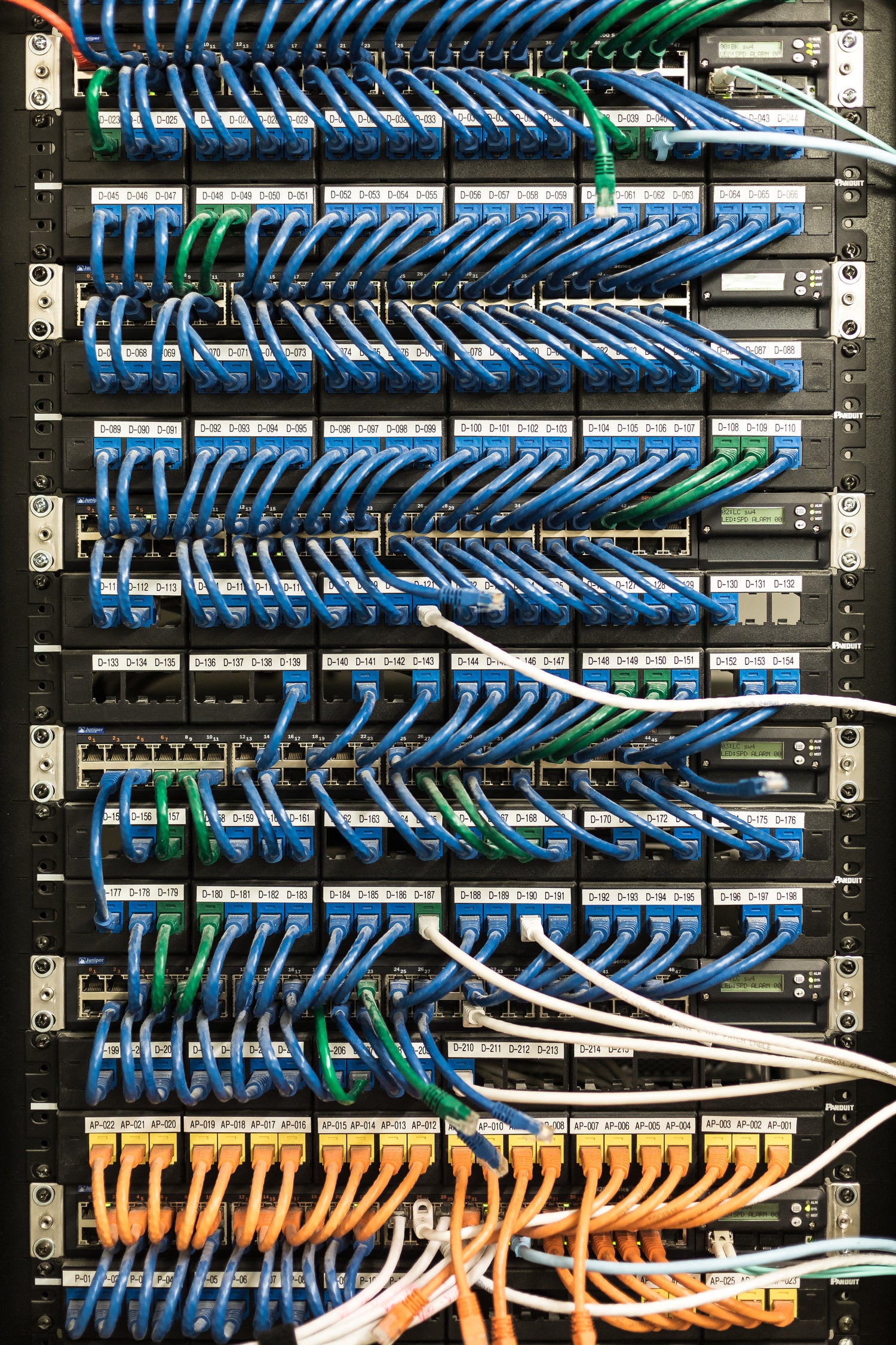

Club Del Internet Network

2023 Summer Women Cargo Pants Women Vintage Washed And Old Pants Casual Straight Multi Pocket Women Denim Pants

Share

Club Del Internet RD - Catalog

-

Beauty and Parfums

Beauty and Parfume. AMOUAGE - Library Opus I Eau De Parfum Spray...

-

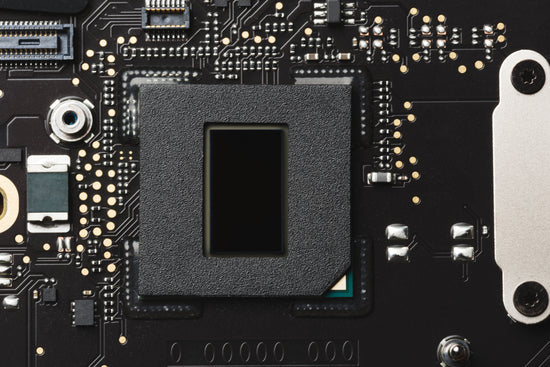

Automobiles and Motorcycles

Automobiles and Motorcycles Auto Replacement PartsCar LightsInterior PartsExterior PartsSpark Plugs & Ignition...

-

Business & Industrial

Business & Industrial

Women's Clothing and collection

-

Women's Solid Color Crew-neck Sleeveless Linen And Cotton Top With Matching Wide-leg Pants

Regular price $18.50 USDRegular priceUnit price per -

new fashion sexy knit low-cut hollow out midriff high waist pack hip slim-fit pants suit woman

Regular price From $3.94 USDRegular priceUnit price per -

Willow Dress In Rome

Regular price $199.00 USDRegular priceUnit price per -

Basic Bae Full Size Round Neck Short Sleeve Dress with Pockets

Regular price $26.00 USDRegular priceUnit price per -

Basic Bae Full Size Ribbed Drawstring Hood Top and Straight Pants Set

Regular price $30.00 USDRegular priceUnit price per -

Double Take Full Size Sleeveless Straight Jumpsuit

Regular price $29.00 USDRegular priceUnit price per -

Printed half-sleeve loose casual pullover top

Regular price $13.30 USDRegular priceUnit price per -

Randa K Fashion Sitarah Women's High Top Sneakers

Regular price $38.32 USDRegular priceUnit price per -

Randa K Fashion Sitarah Sublimation Socks

Regular price $9.87 USDRegular priceUnit price per -

Randa K Fashion Sitarah Women's Cut & Sew Casual Leggings

Regular price From $27.67 USDRegular priceUnit price per -

Randa K Fashion Sitarah Women's Cut & Sew Tee

Regular price From $23.90 USDRegular priceUnit price per

Raquel Collection - Local Products in New Jersey

-

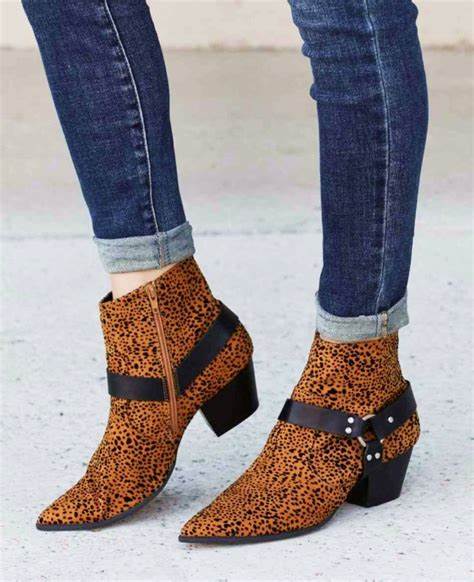

Bags and Shoes

Bags and Shoes Women's Luggage & BagsStylish BackpacksTotesShoulder BagsWalletsEvening BagsClutchesWomen's ShoesWomen's SandalsFlatsHigh...

-

Raquel Collection

Raquel Collection

-

Accessories

Accessories

Men's Clothing and collection

-

Men's Solid color elastic waist multi-pocket loose fit cargo pants

Regular price $22.51 USDRegular priceUnit price per -

2023 New Anime Marvel Men Socks Long Sock Men‘s Knee-High Couples cosplay Sock Personality Hip Hop Harajuku Funny Sock for Women

Regular price From $10.00 USDRegular priceUnit price per -

Randa K Fashion Sitarah Unisex Heavy Cotton Red Tee

Regular price From $23.27 USDRegular priceUnit price per -

OEM Custom Elastic Jogger 97 Cotton 3 Spandex Pants,Multi pocket Tactical Cargo Pants Workwear Climbing Combat Hiking Trousers

Regular price $61.93 USDRegular priceUnit price per$0.00 USDSale price $61.93 USD -

New Mens Tactical Pants Multiple Pocket Elasticity Commuter Tactical Trousers Men Slim Fat Cargo Pant

Regular price $29.89 USDRegular priceUnit price per$0.00 USDSale price $29.89 USD -

Men's Cargo Pants Work Trousers

Regular price $50.98 USDRegular priceUnit price per$0.00 USDSale price $50.98 USD -

IX9 tactical cargo pants Men's Multiple Pockets Trousers work outdoor techwear hiking pantalons homme khaki celana pria casual

Regular price $33.14 USDRegular priceUnit price per$0.00 USDSale price $33.14 USD -

New Design Drawstring Outdoor Sports Jogging Cargo Pants Wholesale Bulk Private Label Mens Side Pockets Track Trousers

Regular price $31.17 USDRegular priceUnit price per$0.00 USDSale price $31.17 USD -

Temperament commuter lapel ladies blazer suit

Regular price $45.33 USDRegular priceUnit price per -

Men's Loose Casual Linen Shirt Cuban Guayabera Short Sleeve Beach Shirt

Regular price $19.35 USDRegular priceUnit price per

Shoes Collection

-

National fashion men's shoes new summer breathable flying woven sports shoes youth Putian Feng running large size fashion shoes

Regular price $16.42 USDRegular priceUnit price per -

Shoes Long Black with Colored Flowers Décor Used

Regular price $15.00 USDRegular priceUnit price per -

Shoes Boot Long White Fabric Used

Regular price $15.00 USDRegular priceUnit price per -

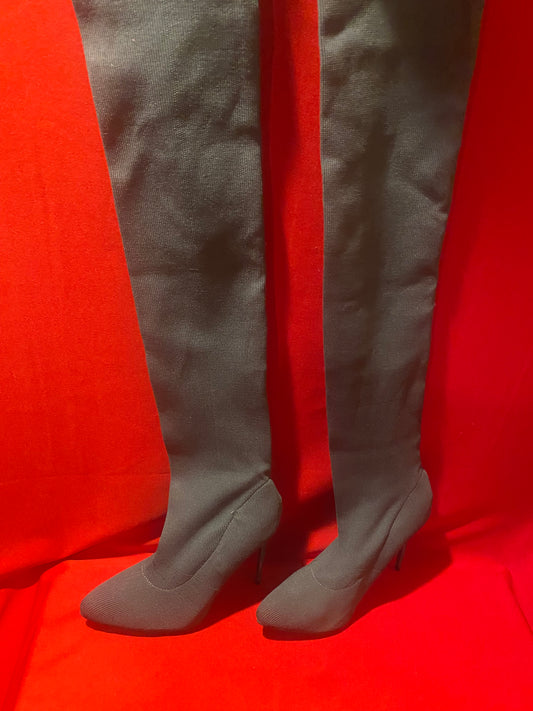

Shoes Boot Long Black Fabric Used

Regular price $15.00 USDRegular priceUnit price per -

Shoes Boot Long Gray Fabric Used

Regular price $15.00 USDRegular priceUnit price per -

Shoes Boot Long Yellow Colored Used

Regular price $15.00 USDRegular priceUnit price per -

Shoes Boot Midsize Black Used

Regular price $15.00 USDRegular priceUnit price per -

Shoes Boot Midsize Black with Silver Decor Used

Regular price $15.00 USDRegular priceUnit price per -

Shoes Boot Long Size Black Used

Regular price $15.00 USDRegular priceUnit price per -

Shoes Boot Midsize ZiGi Girl Silver Used

Regular price $15.00 USDRegular priceUnit price per -

Shoes Boot Midsize ZiGi Girl Brown Silver Used

Regular price $15.00 USDRegular priceUnit price per -

Shoes Boot Midsize ZiGi Girl Brown Used

Regular price $15.00 USDRegular priceUnit price per

Accessories Collection

-

2023 Summer Women Cargo Pants Women Vintage Washed And Old Pants Casual Straight Multi Pocket Women Denim Pants

Regular price $66.02 USDRegular priceUnit price per$0.00 USDSale price $66.02 USD -

cargo pants for men

Regular price $49.98 USDRegular priceUnit price per$0.00 USDSale price $49.98 USD -

Cargo Pants Women'S Color Contrast Line Splicing Hollow-Out Design Sense Of Casual Spice Girl Fashion Wear With Loose Pants

Regular price $46.40 USDRegular priceUnit price per$0.00 USDSale price $46.40 USD -

Coat Ego Purple Used

Regular price $10.00 USDRegular priceUnit price per -

Coat Marcia Collection Brown Used

Regular price $10.00 USDRegular priceUnit price per -

Dog Mom Ball Cap

Regular price $63.00 USDRegular priceUnit price per -

Double Take Color Block Curved Hem Shirt

Regular price $35.00 USDRegular priceUnit price per -

Double Take Full Size Sleeveless Straight Jumpsuit

Regular price $29.00 USDRegular priceUnit price per -

Dress Red Colored Used

Regular price $10.00 USDRegular priceUnit price per -

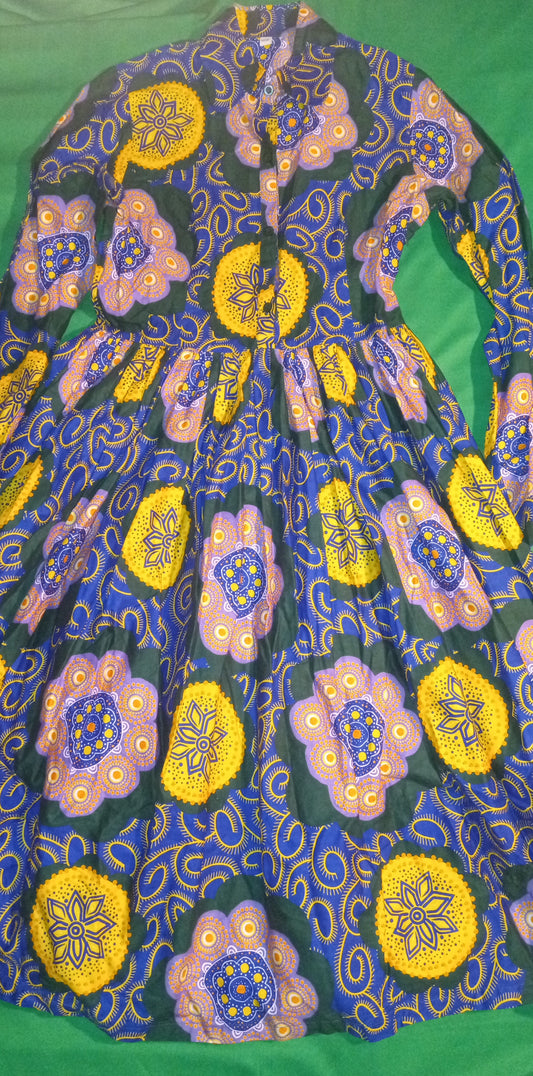

Dress Yellow Blue Colored Used

Regular price $10.00 USDRegular priceUnit price per -

Fall winter 2021 wholesale women stacked sweatpants cargo pants stretch plus size women's fleece washed stacked pants

Regular price $39.94 USDRegular priceUnit price per$0.00 USDSale price $39.94 USD

Sports and Outdoor Collection

-

25x Male+25x Female M10 Copper Brake Pipe Fittings Metric Nuts For 3/16

Regular price $20.89 USDRegular priceUnit price per$26.00 USDSale price $20.89 USDSale -

Bike Bicycle Aluminum Alloy Adjustable Water Bottle Cage Holder

Regular price $5.61 USDRegular priceUnit price per$15.99 USDSale price $5.61 USDSale -

Bike Seat Big Wide Bum Bicycle Saddle Sporty Gel Cruiser Soft Comfort Extra Pad

Regular price $32.99 USDRegular priceUnit price per -

Bicycle Coated Steel Display Floor Rack Bike Repair Stand Used

Regular price $40.50 USDRegular priceUnit price per$76.71 USDSale price $40.50 USDSale -

Bike Biycle Durable Aluminum Alloy Rocket Shaped Valve Stem Caps

Regular price $3.78 USDRegular priceUnit price per$4.13 USDSale price $3.78 USDSale -

New Original Bicycle 29 Mountain Black Mountain Bike Bikes for Men 27.5

Regular price $269.75 USDRegular priceUnit price per -

Bike Wholesale,

Regular price $1,530.00 USDRegular priceUnit price per